Demo Account Startup Incubator

The Demo Account sole purpose is to demonstrate some basic functionality of the Monetryx marketplace and show what a minimally configured company would look like.

THE COMPANY

Why Do We Exist

We exist to educate startup entrepreneurs on how to improve their odds of attracting customers and fostering relationships with both customers and investors through a simple yet thoughtful and carefully executed company public profile strategy.

The Problem

It is not unusual that different people have different opinions and views on the same topic. When the question is the Company Public Profile, the different opinions vary from the vision that the company should show as little as possible to the desire to explain everything the company does and add to it everything the company has ever dreamed of doing too.

We believe that this is a problem and one that needs to be addressed. Often entrepreneurs do not even realize the extent to which their decision on what to include in the public profile of their companies matters. The presentational side of the company profiles is less often overlooked, but it is still viewed as expensive and often ignored.

And while the professional investors tend to focus on the merits of the idea and the business plan of the company, they are people too, and they react positively to a well designed and presented public profile.

We believe we can help inform leaders of startup companies of the importance of balance between content and help them draw more interest in their respective ideas.

Who Has This Problem

Most have this problem. Building an informative and eye-catching company profile is a challenging task. It is even harder than building a pitch to investors. The public profile is supposed to appeal to a much broader audience and yet be informative and reach on substance.

Every entrepreneur who has ever tried to build a public profile of their startup knows how difficult this is, and those who have decided not to spent enough time on it know the cost of doing so.

Our Solution

Our solution is simple. We have prepared this example to illustrate how using simple Monetryx tools you can prepare your company profile and share it with others.

Of course, you could also approach Monetryx or some other expert to help you prepare the content for your public profile.

The solution we offer is limited to a visual demonstration of what could be accomplished with the tools at your disposal.

How Does It Work

If you have already taken the time to work on your Business Model Canvas and have prepared one or more pitch decks to present your idea, you may already have the material you need to start the work on your company's public profile.

If you haven't done any of this, yes, please do it because it will help you generate some or all of the content you need for your public profile.

To help you structure your presentation and make it more informative for the general investor, we have created eight major sections. Most of those sections contain multiple sub-sections, and it is a lot of work to provide content for all of them, but it is also not necessary to do so. You can use the structure we have provided as a guide and do what you find appropriate and essential for your public profile.

-

COMPANY BRIEF

A brief, two to three sentences paragraph describing the company that will show on the top of the profile right under the company's name. No media files allowed for this section.

-

MEDIA

A media gallery folder where you can upload page header images, link videos from Youtube and Vimeo, or upload PDF files you want your visitors to have a chance to review.

All uploaded files will be available in a media gallery-like section right under the company briefing, and the users will be able to browse through them. The most recently uploaded Public Header image will be loaded as the default header image.

Although there is no restriction on the number of media files, we recommend limiting their number to between 5 and 7.

All files will be shown to the visitors in a 19:9 ratio space, and we recommend you optimize your media files for display in this format.

-

THE COMPANY

A long section with multiple subsections allows you to describe different aspects of what you stand for and what your company offers to investors and customers.

You can stick to the subtitles of each subsection or rename them to better fit your needs. Unlike the Company Briefing section, each of the subsections will allow you to enter long descriptions and incorporate various media files.

-

THE BUSINESS

With the company covered, it is now time to describe the business. Like the previous section, you will find multiple sections with headings you may choose to edit and ample space to describe different aspects of your business.

-

THE MARKET SOLUTION

With both the company and the business described, it is time to explain why the market will embrace your products and services and reward your company with attention. Even the best idea and the ultimate product will lead a company to failure unless there is a market ready to embrace it. This section is where you need to make your case and explain how the market will react to your company.

-

THE TEAM

Optional yet helpful space to introduce the key members of your team.

-

THE RISKS

Investing in a startup is a risky business. Everybody knows it, or at least should know it, and that makes it even more important to share the risks you are aware of. Being open and transparent with both customers and investors is the only way to forge fruitful and lasting relationships.

THE BUSINESS

Business Model Canvas

Typically this would be an internal document your company uses to figure out various aspects of the business. It is never meant to be published or shared with investors or customers, but since this is a demo account and not a real business, we will cover it here. The reason is simple - you might find it helpful to have a business model canvas when trying to prepare your public profile. Here are the key sections:

PROBLEM

You start by describing the problem you are trying to address. The better you describe the problem, the easier it is going to be to address it. Just keep in mind that a more extended description is not necessarily a better description, but it is a starting point.

SOLUTION

With the problem clearly described, the solution would be more evident to anyone who cares to read about it. So this is where you specify the solution to the problem so that investors will understand it. As with the description, a longer description is not necessarily a better description but a good starting point.

unique value proposition

With the problem and your solution to the problem, both clearly described why is your solution better than any other solution on the market? Why should your customers choose your solution? What makes it unique in the marketplace? It is not always apparent that a new approach to solving a problem is better than the existing solutions, and this is where you have to explain it in a way that would resonate with customers and potential investors.

secret sauce

For your company to have an edge, you must have something that no one does. Something that even if you were to describe it, no one would be able to copy it because it cannot be reproduced. Patents, proprietary processes, exclusive agreements, a unique team are just a few examples of things that cannot be copied.

customer segments

How do you think the problem and the solution you are proposing interact and split the universe of potential customers into segments? There are many ways to do this and might not be final, but it is a necessary step towards bringing clarity regarding your marketplace and your ability to reach your customers.

key partners

It is hard to build a new business without partnerships. It will be great if some partnerships already existed and can be listed here. Still, in a document like this, you do not have to be limited to describing existing relationships. You are free to list partnerships you believe can help your company, assuming that you will find a way to implement them.

key metrics

How do you measure the success of your company? There could be many metrics, but as a startup company, you will most likely not be able to track them all. However, there must be a few that are more important than the others, and you would like to share them with your potential investors so that they know what to look for.

channels

How do you plan to reach your customers? Like everything else in this document, the plans may change over time. However, outlining your current plans may give an additional perspective to potential investors and help them better assess your business's potentials.

cost structure

This is where you work out what your cost is going to look like, and you want to list your principal costs here.

revenue stream

Businesses cannot exist without a revenue stream. The more revenue streams you have for your business, the better the future of that business. Use this section to describe the revenue streams envision for your company.

THE TEAM

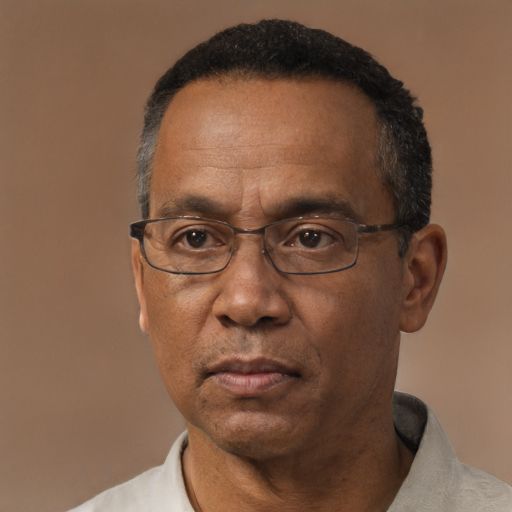

Our team is what drives our success. Years of experience in leaning and presenting various projects have helped us develop a sound understanding of what works and what captivates the eye of both customers and investors.

Of course, this being a demo account, the team listed below is nonexistent but serves our purpose to show it how you could present the team behind your company.

Jason B. Jarvis - CEO

Vestibulum in lacus feugiat, suscipit massa non, varius lorem. Donec pretium tortor rutrum, mollis purus at, ultricies magna. Sed pharetra augue augue, id posuere tellus vestibulum a. Nam lacus eros, varius in ligula sed, semper blandit sem. Nam aliquam neque non scelerisque malesuada. Pellentesque ac euismod odio. Pellentesque augue ante, mattis luctus sapien mollis, auctor placerat ipsum. Duis ut diam erat. Vestibulum in lacus feugiat, suscipit massa non, varius lorem. Donec pretium tortor rutrum, mollis purus at, ultricies magna. Sed pharetra augue augue, id posuere tellus vestibulum a. Nam lacus eros, varius in ligula sed, semper blandit sem. Nam aliquam neque non scelerisque malesuada. Pellentesque ac euismod odio. Pellentesque augue ante, mattis luctus sapien mollis, auctor placerat ipsum. Duis ut diam erat.

Keith Cox - CFO

Donec tortor turpis, interdum sed efficitur a, malesuada vitae libero. Suspendisse in iaculis eros, eget maximus mi. Vivamus vitae elit vel nunc mattis vehicula vitae vel enim. Sed venenatis justo arcu, in tristique metus aliquet ut. Suspendisse bibendum quam a posuere maximus. Nullam a scelerisque ligula. Etiam a risus gravida, congue nisi sit amet, posuere neque. Proin et semper nunc, nec viverra felis. Proin consectetur elit vitae dolor aliquam elementum.

Josephine Tait - Marketing

Vivamus et dictum sapien. Donec aliquam, velit non suscipit rhoncus, augue leo semper nunc, at sollicitudin dui felis vel tortor. Cras vitae felis fringilla, rhoncus sapien in, vehicula nisi. Nullam porta tincidunt fermentum. Cras a lobortis tortor. Sed eu suscipit velit. Nulla in erat dolor. Vivamus elementum urna arcu, vel tincidunt nisi varius id. Morbi tempus, nunc et convallis tempor, orci libero cursus urna, vel tristique nulla justo a lacus. Curabitur velit orci, semper eu consectetur id, scelerisque vel diam. Integer facilisis eleifend varius. Maecenas ac velit blandit, mattis nulla sed, malesuada nulla. Vivamus et dictum sapien. Donec aliquam, velit non suscipit rhoncus, augue leo semper nunc, at sollicitudin dui felis vel tortor. Cras vitae felis fringilla, rhoncus sapien in, vehicula nisi. Nullam porta tincidunt fermentum. Cras a lobortis tortor. Sed eu suscipit velit. Nulla in erat dolor. Vivamus elementum urna arcu, vel tincidunt nisi varius id. Morbi tempus, nunc et convallis tempor, orci libero cursus urna, vel tristique nulla justo a lacus.

THE RISKS

Generic Risk Statement

Investing in startup companies, although potentially very lucrative, carries very high risk. Investing in the Demo Account company, however, comes with a 100% guarantee that you will lose all of your money. This is a demo account after all, and there is no business activity with any potential for generating income.

Nevertheless, if you choose to invest in the Demo Account company, we will appreciate your donations.

Regulatory Risks

Investing in equity of a company that does not exist carries some regulatory risks to both the investor and the individual associated with the company. In the unlikely event that you decide to invest in the Demo Company, please consult your financial advisor before you take any action.